By Tim Estin, mba, gri with Coldwell Banker Mason Morse

By Tim Estin, mba, gri with Coldwell Banker Mason Morse

ASPEN, CO -- Although the Aspen real estate market has stabilized, and the inventory of properties for sale in the first half of 2013 is down -11% over the same time last year and down -31% since the first half of 2009, inventory continues to be comparatively high. Current inventory is 68% higher, and property sales are 32% less, than what they were in the first half of 2004 (the beginning of the 2000’s market climb), according to half-year figures released recently by The Estin Report.

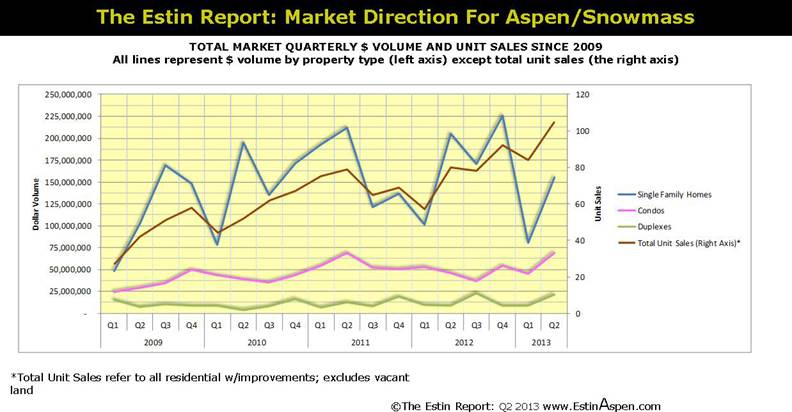

The Aspen real-estate market has certainly improved since the dark days (2nd Quarter 2010) of the recession, but not on an upward trajectory as expected. In the first half of 2013 (January 1-June 30), the number of units or properties sold was up by 28 percent over the same time last year--201 versus 157--yet dollar sales volume was down by 16 percent: $401M this year compared to $479M last year. So far, 2013 has seen a wave of lower-end sales, especially single-family homes priced under $2M and condos under $1M, both selling at considerable discounts to the peak market prices of five years ago. Aspen’s average prices per-square-foot have stabilized near first-half 2006 levels at $1,026/sq.ft. for single-family homes and $927/sq.ft. for condos.

Aspen--and Vail, too--lags behind other high-profile luxury markets such as the Hamptons, Martha's Vineyard, Nantucket, and the West Coast, mostly weekend and second-home markets. “Historically, Aspen has been last-in, first-out of recessions, but it feels more like Aspen is last out this time,” says Tim Estin, author of The Estin Report and broker with Coldwell Banker Mason Morse. “Is it the resort market specifically, and not just Aspen? Even though there’s anecdotal evidence that Aspen is leading the destination resorts out of the recession, at least in Rocky Mountain areas.”

Still, the past nine months (October 1, 2012 - June 30, 2013) have experienced the greatest fluctuation in Aspen real estate dollar sales in the nearly five years since the crisis began. Call it the carryover effect: the unprecedented strength ofDecember 2012 sales,motivated by tax and capital gains changes for 2013, may be largely responsible for a lackluster first half of 2013.

“Sellers are expecting higher prices because of the positive national real-estate trends,” Estin says, “but buyers don’t see the comparable sales to support the price increases the sellers expect.”

**Hi-res images available upon request

__________________

Disclaimer: The statements made in The Estin Report represent the opinions of the author and they should not be relied upon exclusively to make real estate decisions. Information concerning particular real estate opportunities can be requested from Tim Estin at 970.920.7387 or by email. A potential buyer is advised to make an independent investigation of the market and of each property before deciding to purchase. To the extent the statements made herein report facts or conclusions drawn from other sources, the information is believed by the author to be reliable. However, the author makes no guarantee concerning the accuracy of the facts and conclusions reported herein. The Estin Report is copyrighted 2013 and all rights are reserved. Use is permitted subject to the following attribution: "The Estin Report by Aspen broker Tim Estin mba, gri" www.EstinAspen.com.